Collections Operations everywhere now need to substantially increase their level of collections automation. Why? Because the cost of collections is at an all-time high for both 1st and 3rd party collections entities. If you are a collection agency, the situation may be even more dire given higher collection costs are making profit margins razor thin. The situation is not expected to get any better in the near term given employee wages are on the rise, and new regulatory requirements are coming forward that are sure to impact collections costs. Also, there is an increase in collections volume expected later this year after COVID-19 virus-related financial relief programs are discontinued.

It is important to note that during the pandemic, many collections operations added a lot more manual processes to an already overburden amount. The general thinking has always been that going “manual” was a quick and simple way to remedy a given collection situation. Unfortunately, these one-off manual processes or actions have quietly accumulated into an inordinate amount. These manual efforts – when viewed individually – are generally innocuous endeavors and entail minimal human effort. However, when taken in the aggregate, they collectively represent a major labor drain, as well as a drag on efficiency, and a substantial impact on overall operational expense.

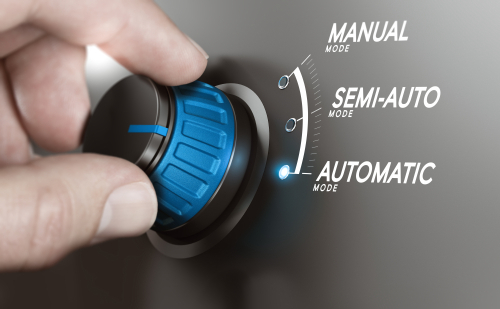

Considering the above, raising your level of collections automation is one of the best ways to counter rising collections costs. The results can be immediate and have a dramatic positive impact on the financial bottom line. Not to mention, automation generally enables you to “do more with the same or less” and can help improve overall collections performance and compliance.

Therefore, when it comes to upping your level of collections automation, you need to consider two important things: 1) Key Areas of Automation to Focus on, and 2) Collection Software System Automation Capabilities.

Key Areas of Automation to Focus On

Collections and Recovery Workflows

Reduce/remove manual actions within workflows and processes. Especially regarding “special handling” workflows that tend to entail a large amount of manual effort (disputes, repossessions, bankruptcy, deceased, legal). Also, seamlessly integrate workflows to enable the easy movement of accounts and information between workflows automatically.

Agent Desktop Activities

Minimize the number of agent keyboard strokes and mouse clicks by automating more of the agent’s workload. This includes certain activities such as data entry, information lookups, agent “next steps”, taking payments, and setting up payment plans. Additionally, creating and sending customer follow-up communication and documents (letters, emails, texts, billing statements), and viewing prior collection actions are all agent activities that can be automated. Lastly, automate agent commission/bonus tracking that is done manually by agents working in outdated collections software.

Data Transmission / Integration Points

Automate the process of receiving and sending data files associated with new delinquent account onboarding, host system updates, and with external data/service providers (data scrubs/appends, letters, and other 3rd party collections related services). Also, where possible, establish real-time integration between the collection system and other platforms/applications using modern APIs that provide a more timely and frictionless exchange of information (PSPs, dialers, digital channel messaging).

Reporting / Tracking / Monitoring

Establish automated data extraction programs periodically throughout the day to support more automated report generation for timely insights and analysis. Automate manual monitoring, tracking activities, and associated manual alerts/notifications (broken promise, NSF, missed due date, bankruptcy/deceased, repossession, consent status).

Compliance

Remove desktop compliance sticky notes, and collection rules cheat sheets to establish automated rules policies and/or guidelines that systematically drive agent compliance requirements and screen pop-ups for each account.

Customer Contact / Engagement

Automate digital outbound/inbound messages (1 & 2-way SMS messages and emails) within workflows and at the agent’s desktop. Integrate and automate communication channel control and orchestration previously performed manually by agents and communication system managers. Automate efforts to count, track, and manage all contacts and consent.

Agentless Collections

Establish a highly interactive consumer self-serve collections portal that automatically provides the consumer with information about their delinquent account, repayment options, and associated documentation. Enable debtors to easily drive their debt repayment or settlement plan with the same options and parameters offered by agents. Leverage interactive Chatbots to automatically guide and interact with customers to provide initial collection assistance via chat windows.

Collection System Automation Capabilities

A key factor when it comes to raising your level of collection automation is the automation capabilities of your debt collection software. While all collections software systems offer some level of automation, the degree and ease of automation that they can provide varies widely. It is a function of the collections software system’s underlying technology and designs that dictate the degree of automation. Many legacy systems with outmoded technology are not likely to have the requisite features and functions needed for the higher levels of automation most collections operations will need going forward. In these situations, collection operations often go the custom development route, which has its benefits and risks. The drawbacks are cost, development time – and most importantly – the risk of the custom work falling short of the expected automation capability. In order to move to a higher level of automation, collection systems should have several key features and functions that are generally found in more modern collections software systems, such as:

- System-wide Interoperability (throughout and across collections and recovery capabilities)

- Robust Centralized Strategy / Rules Engine

- Broad DIY System Configurability

- Omni-Channel Integrated Communications

- Embedded Digital Channel Communications

- Real Time Processing / Updating

- Seamless Integration with other Platforms, Applications, Vendors, and Service Providers

- Highly Flexible & Extensible Database

- Customer Centric Collections Enabled

- Interactive Consumer Self-Assist Collections Portal

- Advanced Analytics and Decisioning Tools (Machine Learning / AI) Compatible

Note that certain legacy debt collection technology may be able to support a higher level of automation, but it could also require time, resources, and costs that can be restrictive. Therefore, it is always important to weigh the effort and cost to automate a specific process or activity against its expected benefit, as well as its broader impact on moving to a higher level of automation. Just remember when doing this time, resources, and cost-to-benefit analysis that you do not fall into the trap of being “penny-wise and pound-foolish”…or you may end up in the manual process nightmare you were intending to leave behind.

Conclusion

Collection costs are at an all-time high and increasing. At the same time, the number of manual collections activities in place and being added is exceedingly high and more than leadership may realize. Therefore, the need to up your collections automation game has never been greater and can no longer be “put on the backburner”. The situation is only going to get worse with the arrival of additional collections challenges materializing in the near term. The time, resources, and cost to significantly increase your level of automation are tied to the capabilities of your collection system. Older systems are less likely to have what it takes to support higher levels of automation, while modern systems such as Optimus by Telrock, have the requisite capabilities, and more.

Ultimately, there is a cost for moving to higher levels of collection automation – be it a function of enhancing your existing system or moving to a more modern system. In any event, moving to a higher level of collection automation can provide tremendous savings and productivity gains. Going forward, your level of collections automation will be the key to collections success, and for many a necessity for survival.

About the Author

Robert Fite has compiled over 30 years of experience in the credit & collections industry with extensive expertise in decision management software tools, credit data, risk scoring, and collection technology. He has held leadership positions with Experian, Fico, and LexisNexis Risk Solutions, working with hundreds of lenders of all types, sizes, and credit products throughout North America.

About Telrock

This article has been brought to you by Telrock, a global technology provider of modern cloud-based collections software built new from the ground-up for creditors and 3rd party consumer collections organizations. Telrock leverages open-sourced technology, powerful cloud computing, and more intelligent designs to provide the broadest and richest set of Software-as-a-Service (SaaS) capabilities. We deliver and support our solutions in North America from our Atlanta, USA office and in Europe, Middle East, and Africa (EMEA) from our London, UK office. Telrock’s key solution serving the collections market is Optimus, a modern cloud-based collections software platform that offers advanced capabilities, enhanced compliance, higher performance and delivered as a SaaS solution.